New York Standard Deduction Vs Itemized . Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. We briefly describe the difference between federal and new york state itemized deduction rules below. The choice between standard deduction vs. Itemized deductions comes down to claiming a flat dollar amount determined by the. 7 rows standard deduction amount. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. When they add up to more than the standard deduction, itemized deductions can save more on taxes. We briefly describe the difference between federal and new york state itemized deduction rules below. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Itemized deductions are tax deductions for specific expenses.

from www.slideserve.com

Itemized deductions comes down to claiming a flat dollar amount determined by the. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. The choice between standard deduction vs. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. 7 rows standard deduction amount. When they add up to more than the standard deduction, itemized deductions can save more on taxes. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. We briefly describe the difference between federal and new york state itemized deduction rules below. We briefly describe the difference between federal and new york state itemized deduction rules below. Itemized deductions are tax deductions for specific expenses.

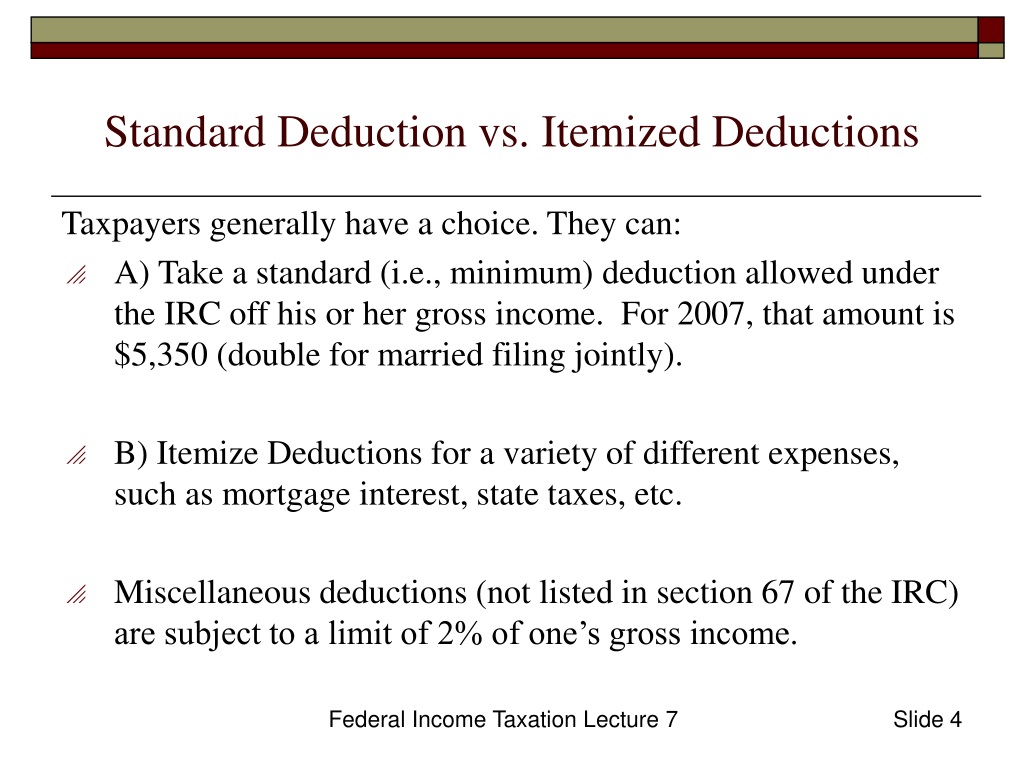

PPT Current Individual Tax Rates 1 PowerPoint Presentation

New York Standard Deduction Vs Itemized Itemized deductions comes down to claiming a flat dollar amount determined by the. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. We briefly describe the difference between federal and new york state itemized deduction rules below. 7 rows standard deduction amount. The choice between standard deduction vs. Itemized deductions comes down to claiming a flat dollar amount determined by the. We briefly describe the difference between federal and new york state itemized deduction rules below. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. When they add up to more than the standard deduction, itemized deductions can save more on taxes. Itemized deductions are tax deductions for specific expenses. Claiming the standard deduction is easier, because you don’t have to keep track of expenses.

From taxedright.com

Itemized Deductions vs Standard Deduction Taxed Right New York Standard Deduction Vs Itemized According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. When they add up to more than the standard deduction, itemized deductions can save more on taxes. Itemized deductions are tax deductions for specific expenses. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. We. New York Standard Deduction Vs Itemized.

From www.youtube.com

What is the difference between itemized tax deduction vs standard tax New York Standard Deduction Vs Itemized The choice between standard deduction vs. 7 rows standard deduction amount. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100.. New York Standard Deduction Vs Itemized.

From www.slideserve.com

PPT Current Individual Tax Rates 1 PowerPoint Presentation New York Standard Deduction Vs Itemized Itemized deductions comes down to claiming a flat dollar amount determined by the. We briefly describe the difference between federal and new york state itemized deduction rules below. When they add up to more than the standard deduction, itemized deductions can save more on taxes. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together,. New York Standard Deduction Vs Itemized.

From www.pdffiller.com

Fillable Online Itemized vs Standard Deductions for NY Form IT201 in New York Standard Deduction Vs Itemized Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Itemized deductions are tax deductions for specific expenses. Itemized deductions comes down to claiming a flat dollar amount determined by the. The choice between standard deduction vs. When they add up to more than the standard deduction, itemized deductions can save more on taxes. We. New York Standard Deduction Vs Itemized.

From www.youtube.com

Itemized Deductions vs. Standard Deduction YouTube New York Standard Deduction Vs Itemized We briefly describe the difference between federal and new york state itemized deduction rules below. When they add up to more than the standard deduction, itemized deductions can save more on taxes. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Itemized deductions are tax deductions for specific expenses. 7 rows standard deduction amount.. New York Standard Deduction Vs Itemized.

From www.picnictax.com

Standard Deduction vs Itemized How To Pay Less In Taxes Picnic New York Standard Deduction Vs Itemized Itemized deductions comes down to claiming a flat dollar amount determined by the. 7 rows standard deduction amount. We briefly describe the difference between federal and new york state itemized deduction rules below. Itemized deductions are tax deductions for specific expenses. The choice between standard deduction vs. Single (and can be claimed as a dependent on another taxpayer's federal return). New York Standard Deduction Vs Itemized.

From www.bastianaccounting.com

Standard Deduction Versus Itemized Deduction — Bastian Accounting for New York Standard Deduction Vs Itemized The choice between standard deduction vs. We briefly describe the difference between federal and new york state itemized deduction rules below. We briefly describe the difference between federal and new york state itemized deduction rules below. When they add up to more than the standard deduction, itemized deductions can save more on taxes. Itemized deductions are tax deductions for specific. New York Standard Deduction Vs Itemized.

From www.pinterest.com

Itemized vs. Standard Tax Deductions Pros and Cons RamseySolutions New York Standard Deduction Vs Itemized When they add up to more than the standard deduction, itemized deductions can save more on taxes. Itemized deductions comes down to claiming a flat dollar amount determined by the. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. Itemized deductions are tax deductions for specific expenses. We briefly describe the difference between federal and. New York Standard Deduction Vs Itemized.

From thewealthywill.wordpress.com

Standard Deduction vs. Itemizing Which is the Best Option for You New York Standard Deduction Vs Itemized The choice between standard deduction vs. 7 rows standard deduction amount. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Itemized deductions are tax deductions for specific expenses. Itemized deductions comes down to claiming a flat dollar amount determined by the. We briefly describe the difference between federal and new york state itemized deduction. New York Standard Deduction Vs Itemized.

From universaltaxprofessionals.com

Standard Deduction vs. Itemized Deduction Universal Tax Professionals New York Standard Deduction Vs Itemized We briefly describe the difference between federal and new york state itemized deduction rules below. Itemized deductions are tax deductions for specific expenses. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. When they add up to more than the standard deduction, itemized deductions can save more on taxes. According to tax pros, itemizing generally. New York Standard Deduction Vs Itemized.

From wealthfactory.com

Standard Deductions vs. Itemized Choosing Wisely Wealth Factory New York Standard Deduction Vs Itemized According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. We briefly describe the difference between federal and new york state itemized deduction rules below. 7 rows standard deduction amount. Itemized deductions comes down to claiming a flat dollar amount determined by the. We briefly describe the difference between federal. New York Standard Deduction Vs Itemized.

From www.diffzy.com

Itemized Deductions vs. Standard Deductions What's The Difference New York Standard Deduction Vs Itemized Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. The choice between standard deduction vs. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. We briefly describe the difference between federal and new york state itemized deduction rules below. Claiming the standard deduction is. New York Standard Deduction Vs Itemized.

From universaltaxprofessionals.com

Standard Deduction vs. Itemized Deduction Universal Tax Professionals New York Standard Deduction Vs Itemized 7 rows standard deduction amount. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. Single (and can be claimed as a dependent on another taxpayer's federal return) $3,100. We briefly describe the difference between federal and new york state itemized deduction rules below. Itemized deductions comes down to claiming. New York Standard Deduction Vs Itemized.

From www.bastianaccounting.com

Standard Deduction Versus Itemized Deduction — Bastian Accounting for New York Standard Deduction Vs Itemized Claiming the standard deduction is easier, because you don’t have to keep track of expenses. 7 rows standard deduction amount. Itemized deductions are tax deductions for specific expenses. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. We briefly describe the difference between federal and new york state itemized. New York Standard Deduction Vs Itemized.

From winningstockplays.com

Standard Deduction vs. Itemized Deductions Which Is Better? Winning New York Standard Deduction Vs Itemized When they add up to more than the standard deduction, itemized deductions can save more on taxes. The choice between standard deduction vs. We briefly describe the difference between federal and new york state itemized deduction rules below. Itemized deductions comes down to claiming a flat dollar amount determined by the. 7 rows standard deduction amount. According to tax pros,. New York Standard Deduction Vs Itemized.

From www.simpleprofit.com

Standard vs. Itemized How Deductions Work New York Standard Deduction Vs Itemized We briefly describe the difference between federal and new york state itemized deduction rules below. According to tax pros, itemizing generally only makes sense if your itemized deductions, taken together, add up to more than. Itemized deductions comes down to claiming a flat dollar amount determined by the. The choice between standard deduction vs. Single (and can be claimed as. New York Standard Deduction Vs Itemized.

From www.pinterest.com

Standard Deduction vs. Itemized Deductions Which Is Better? — TurboTax New York Standard Deduction Vs Itemized We briefly describe the difference between federal and new york state itemized deduction rules below. The choice between standard deduction vs. Itemized deductions are tax deductions for specific expenses. We briefly describe the difference between federal and new york state itemized deduction rules below. When they add up to more than the standard deduction, itemized deductions can save more on. New York Standard Deduction Vs Itemized.

From www.onenewspage.com

Standard Deduction versus Itemized Deductions One News Page VIDEO New York Standard Deduction Vs Itemized We briefly describe the difference between federal and new york state itemized deduction rules below. We briefly describe the difference between federal and new york state itemized deduction rules below. Claiming the standard deduction is easier, because you don’t have to keep track of expenses. Itemized deductions comes down to claiming a flat dollar amount determined by the. Itemized deductions. New York Standard Deduction Vs Itemized.